The following is a lightly edited transcription from The Punch Out with Eugene Puryear, a daily news podcast that comes out Monday through Friday, 5pm ET. Subscribe here.

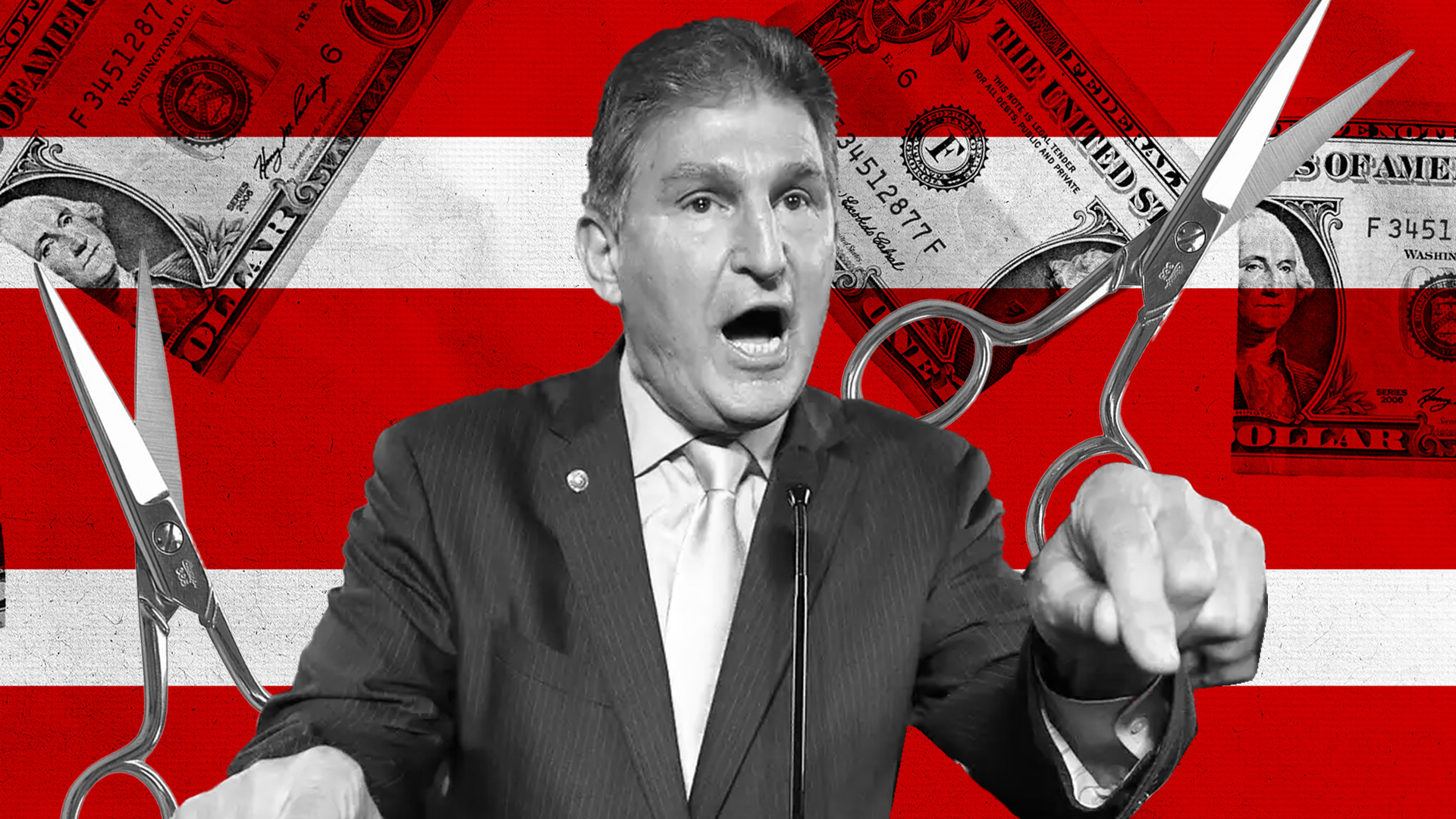

Sen. Joe Manchin (D-WV) is demanding a massive $2 trillion cut to the proposed $3.5 trillion budget reconciliation bill.

One main area for cutbacks he has been floating is with the child tax credit, so that the maximum amount of money stays in the hands of the ultra-rich. The expanded version of the tax credit that Manchin wants to tank, for instance, would reduce child poverty by 40 percent.

One of Manchin’s ideas is to add a “work requirement” to this child tax credit expansion. In other words, if you don’t have income in a given year, or a very low income, you would not be able to receive the tax credit.

The work requirement applies to the way you file taxes essentially — a proposal that is actually the way the tax credit used to function until the American Rescue Plan expanded the credit last year.

Prior to the American Rescue Plan, the child tax credit could only offset income — so it was only available if you filed taxes and had an income. However, many people do not make enough money to owe taxes and do not have to file, or, may be unemployed in a given year but still file for other reasons. So the biggest critique of the tax credit for years is, it didn’t reach the poorest families that really need the help the most.

The new system would send out the credit as a monthly check, providing real-time help for families and setting it up so that even if you have a very low income or no income, you are still able to get it. What Manchin wants is to go back to the old system where the poorest families get very little help.

Now, there is a lot to be said about this, but one central thing is that the expanded child tax credit has been used for the purchase of food in a large number of cases. Manchin’s plan literally takes food out of the mouths of children, to help relieve billionaires of new taxation.

The other thing is that Manchin’s whole rationale is built on a pack of lies. The implication of Manchin’s position is that allowing low income families to access the tax credit will keep them from working as they live “high on the hog” off free government money. This is false on many levels.

First, it’s several hundred dollars a month — max $3,600 a year — not a million dollars. Secondly though, the structure of the tax credit itself, shows that the “work incentive” fear is absolutely not an issue. The tax credit does not start to phase out until $112,500 for a head of household and $150,000 for a married couple filing jointly; ultimately a married couple can make up to $400,000 and still be getting the credit.

The people Manchin wants to exclude are more or less people making $15,000, unemployed people and so on. Who goes from $15,000 to over $112,500 in one year? Hardly anyone. It is absurd that because of $3,600 per year someone with kids is disincentivized to find a job — when finding a job would allow them to continue receiving the credit.

In fact, it is the opposite, it’s actually an incentive to do whatever you can to increase your income because the impact of the tax credit will be even greater for low income families. The credit could play a major role in paying for the cost of childcare, and make it easier for women to work as well.

Don’t just take my word for it: the National Academy of Sciences convened an expert panel to look at the effect of a similarly constructed tax credit as the proposal in the budget bill and found: “99.5 percent of working parents would continue to work, and few would substantially reduce their hours.”

There is also the fact that, of the people who get the child tax credit now, the Center for Budget and Policy Priorities found that “in more than 95 percent of families who benefit from making the credit fully refundable, the parent or other caretaker is working, between jobs, ill or disabled, elderly, or has a child under age 2.”

Also, Canada has a similar tax credit and a recent study on its impact found: “no detectable influence on employment for single mothers, the adults most likely to be affected.”

There is also the fact that France, Germany, the UK and Canada all have a higher labor force participation rate — more people working — than the United States, and all have far more generous benefits for families.

The immediate impact of the child tax credit in Manchin’s own state of West Virginia is clear. After the first month of the child tax credit payments this year, hunger for kids in West Virginia dropped by 3% and one study found that only seven states gained more of a benefit than West Virginia from the credit. So he isn’t just taking food out of kids’ mouths, but out of the kids in his own state.

So don’t be fooled, Manchin’s opposition to the budget reconciliation bill is based on an outright slander that just demonizes poor people without any evidence. It has only one real purpose: to make sure the rich stay rich, and give up basically nothing.

BreakThrough News is building the media arm of the movement. We tell the untold stories of resistance from poor and working-class communities — because out of these stories we will construct a different narrative of the world, as it is and in real time.

Think to yourself, is this article something that would be published anywhere other than BreakThrough?

Five mega-corporations dominate the media landscape — controlling 90% of what we read, watch and listen to. People’s movements in every corner of the globe are changing history and shifting consciousness. But these movements barely receive any coverage from the corporate media. They need visibility. They need amplification. They need a media arm to break through.

Working-class people deserve better, we deserve media for and by us. We are not funded by billionaires or corporations – we are funded by you. Without you, BreakThrough would not be possible, so become a member and build the media arm of the movement with us.

To send a check to BreakThrough News, please make it out to BreakThrough / BT Media Inc. and send to 320 W. 37th Street, NY, NY 10018. Donations are tax-deductible in accordance with the law.

Eugene Puryear is a longtime journalist and community organizer currently-based in New York City. Eugene helped to organize a number of the large-scale demonstrations that took place against the continuing U.S. war and occupation of Iraq and Afghanistan, he was a key leader In the struggle to free the Jena Six in 2007, and a founder of the anti-gentrification group Justice First, the Jobs Not Jails coalition, DC Ferguson Movement and Stop Police Terror Project-D.C. Puryear is the author of the book Shackled and Chained: Mass Incarceration in Capitalist America, and spent five years in radio prior to helping found BT News.